The Board of Directors of Aquafil approved the company’s operating and financial results at December 31, 2021. Figures show revenues of 569.7 million euros, equal to an increase by 30.5% compared to the 436.6 million euros of 2020, an Ebitda of 72.1 million euros, up by 23.5% compared to 58.4 million of euros in 2020, and a net profit of 10.7 million euros compared to 6 million euros in 2020.

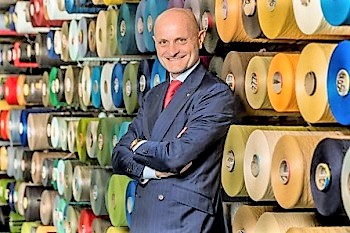

The financial year of 2021 demonstrated the Group's ability to grow vigorously and consolidate significant results, pursuing its circularity objectives and clearly implementing its strategy. Indeed, the economic and financial results achieved are show up not only compared to 2020 but with respect to 2019 nonetheless the strong impact of energy costs that characterised the fourth quarter in Europe. Econyl after all represents around 37% of fibre revenues and the continue continued its strategy of integrating the collection of waste for regeneration. In October, we finalised the acquisition of a significant stake in the Norwegian company Nofir, which specialises in the collection of fishing nets. This is a further step in our efforts to control the supply chain, following the acquisition of Planet Recycling in December 2020, which specialises in collecting end-of-life carpets. Now under its new name, Aquafil Carpet Collection, it has already doubled its collection points”, Giulio Bonazzi (in the picture below), chairman and CEO of Aquafil, stated.

“The year 2022 started positively and in line with our forecasts following the sales price increases implemented to recover the cost increases that had arisen in the fourth quarter of 2021. However, the conflict between Russia and Ukraine has changed the current scenario bringing significant instability that will certainly have negative consequences on the economic growth globally and especially on European markets. We have prepared specific management plans to respond to a likely contraction in European demand in the coming weeks. We are ready, together with our customers and suppliers, to face the contingent situation, through the constant monitoring of its evolution and the implementation of all the necessary actions in order to mitigate the adverse effects that could arise. We do not see any particular impact in the other geographical areas where the Group operates. In fact, both in the United States and in Asia, this first period of the year showed demand levels in line with our expectations for all products and inflationary trends that are not comparable to those in Europe. Despite the current negative scenario and its highly unpredictable evolution, in the medium term we are optimistic and fully focused on implementing our strategy and creating value for all our stakeholders” Bonazzi added.

“The year 2022 started positively and in line with our forecasts following the sales price increases implemented to recover the cost increases that had arisen in the fourth quarter of 2021. However, the conflict between Russia and Ukraine has changed the current scenario bringing significant instability that will certainly have negative consequences on the economic growth globally and especially on European markets. We have prepared specific management plans to respond to a likely contraction in European demand in the coming weeks. We are ready, together with our customers and suppliers, to face the contingent situation, through the constant monitoring of its evolution and the implementation of all the necessary actions in order to mitigate the adverse effects that could arise. We do not see any particular impact in the other geographical areas where the Group operates. In fact, both in the United States and in Asia, this first period of the year showed demand levels in line with our expectations for all products and inflationary trends that are not comparable to those in Europe. Despite the current negative scenario and its highly unpredictable evolution, in the medium term we are optimistic and fully focused on implementing our strategy and creating value for all our stakeholders” Bonazzi added.