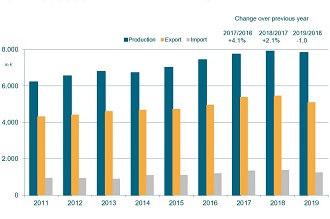

German plastics and rubber engineering in a nosedive

As expected, in 2019 the soaring rise in turnover of the past years has come to a halt: German plastics and rubber machinery manufacturers had to resign themselves to a turnover fall of 6 per cent. This is what VDMA, the federation of the German mechanical industry, refer in its annual report. "However, after 11 years of growth this break did not come as a surprise for the industry," Ulrich Reifenhäuser, Chairman of the VDMA trade association Plastics and Rubber Machinery, put it in a nutshell. "In many major customer industries, above all the automotive sector, signs suggested investment restraint, something that had already become clear for a while when looking at the order books. Moreover, there is the image problem of plastics," Reiferhäuser added.

This difficult situation is aggravated by the coronavirus pandemic. Until June 2020, orders saw a decline of altogether 20 per cent compared to the previous year. "The pandemic was the stab in the back for customer industries that had already been performing badly. However, we also notice that in times of the Corona crisis many plastics and rubber machines are being supplied particularly to the sectors of medical engineering and packaging, Thorsten Kühmann, Managing Director of the VDMA trade association, explained.

Image of plastic is improving

Wherever hygiene comes into play plastics show their advantages. "This leads to a noticeable image improvement in society," said Kühmann. "However, we are aware that we are currently undergoing an exceptional situation and the shift in image will not have a long-term impact." The industry already laid the foundation for long-term change and committed itself to circular economy at the K-show in October last year.

Markets are shifting

In the first five months of the current year, German exports of plastics and rubber machinery fell short of the previous year results by 19%. Exports to China and to the US decreased by 3% each due to the coronavirus crisis. For the Chinese market, positive signals can already be perceived while the present decline in exports to the US is only the beginning. The impacts on European countries strongly affected by the coronavirus are also reflected in export statistics. Deliveries to Italy (-31%), to France (-42%) and to Spain (-48%), for example, saw a clear drop. But considerably fewer machinery was also exported to India (-73%). Markets importing over-proportionally more German plastics and rubber machinery in the first five months of 2020 compared with the previous-year period were Russia (+28%) and Turkey (+102%).

The future will remain challenging but also offers chances

The coronavirus pandemic alone provides sufficient insecurity for future economic development as the risk of a second wave is still looming. This is accompanied by somber prospects for the automotive industry as well as the persistently tense trade relationship between the US and China, oppressing the export-oriented engineering sector. In  addition, the adopted tax on plastics is further clouding over the situation. Small wonder that the majority of manufacturers of plastics and rubber machinery stated that they expected a turnover decline of up to 30% in 2020.

addition, the adopted tax on plastics is further clouding over the situation. Small wonder that the majority of manufacturers of plastics and rubber machinery stated that they expected a turnover decline of up to 30% in 2020.

To begin with, the European Union is successfully pointing the way towards a positive economic trend with the Heads of State and Government agreeing on an economic development plan to cope with the economic impacts of the coronavirus crisis. The ability to act thus shown is a strong signal.

A clear 80% majority of plastics and rubber machinery manufacturers expect a return to the turnover volumes of 2019 in 2022 at the latest. Not few expect this already to happen next year. For the second half of 2020, many expect incoming orders from West Europe and China to recover. This already indicates at first signs of a turnaround.

Furthermore, machinery manufacturers will continue to contribute their share to implementing a successful circular economy. The innovative capacity of the industry is still unbroken and will also lead the technology providers out of this crisis.