RadiciGroup: turnover, Ebitda and net income growing

Consolidated sales revenue of 1,211 million euros (+ 6%), Ebitda of 185 million euros (+16%) and net income, after depreciation, amortization and writedowns, of 97 million euros (+19%): these are RadiciGroup’s key figures for financial year 2018. The Group - with 3,100 employees in 16 countries - engages in the chemicals, engineering polymers and synthetic fibres businesses.

“2018 was an exceptional year”, said Angelo Radici, president of RadiciGroup. “The year closed with record-breaking numbers for our Group. And we achieved these results despite the fact that, during the last part of the year, we felt the first symptoms of a slowdown, which is still underway in 2019. At any rate, I think I can safely say that we are going to have a first half with stable margins despite the contraction in sales volumes. The second half of the current year is going to be a bit tougher. Nevertheless, the outlook calls for positive results, even if surely lower than in 2018. The global scenario in which our companies operate is most certainly affected by the uncertainties caused by the US-China import tariffs battle and by general geopolitical instability. Another factor weighing heavily on our business is the contraction in the automotive market. We are trying to handle this difficult situation by putting a lot of effort into research and innovation aimed at widening our product portfolio, by adding materials with low environmental impact and creating new market opportunities catering to the growing environmental concerns of companies”.

In this context, the Group is continuing to pursue its strategy of focusing on its core strategic businesses, such as chemicals for nylon production, engineering polymers and synthetic fibres, also made from renewable source materials. The goal of the Group’s strategy is to improve its competitive position and achieve an overall balance among the geographical markets where it operates, in order to reduce dependency on single markets.

Alessandro Manzoni, CFO of RadiciGroup commented: “Our improved net financial position like all our capital ratios compared to 2017, our relationships of mutual trust with financial institutions and our absolutely sound financial condition have put us in the position to be ready for any growth opportunities that come along, without the need to resort to external capital financing”.

Alessandro Manzoni, CFO of RadiciGroup commented: “Our improved net financial position like all our capital ratios compared to 2017, our relationships of mutual trust with financial institutions and our absolutely sound financial condition have put us in the position to be ready for any growth opportunities that come along, without the need to resort to external capital financing”.

“In 2018”, Manzoni added, “we made capital investments of over 50 million euros and, for 2019, we have planned the same amount. Our goal is to maintain our high level of technological excellence to keep our company competitive, yet safeguard the environment”.

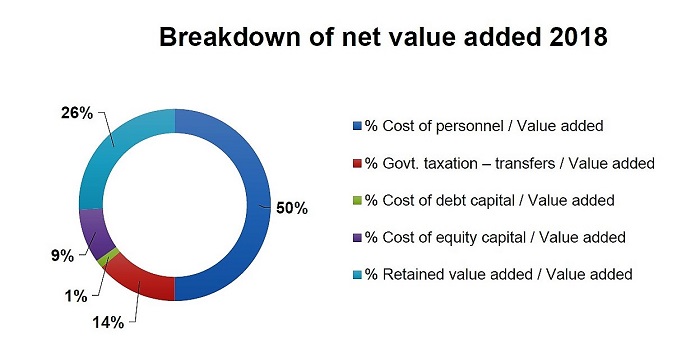

It is important to highlight not only the positive results of RadiciGroup but also the fact that the Group sought to achieve profits and financial soundness while safeguarding the environment and its natural resources. In 2018, the net gross value added (the ability of a company to generate wealth for all its stakeholders - see graph below) continued to rise to 280 million euros (from 258 million euros in 2017), which corresponded to a drop in the amount of resources used, such energy and water, as well as a decrease in waste and emissions produced.