Production, consumption and, above all, recycle of PET in Europe

Icis, a global source of commodity intelligence, together with Plastics Recyclers Europe, Petcore Europe, Unesda Soft Drink Europe and Natural Mineral Waters Europe, launched the “State of Play 2024” study, offering a detailed examination of the PET market in Europe in 2022. The comprehensive study includes data for the 27 EU member states plus Norway, Switzerland, and the United Kingdom and covers various aspects of the PET market, including PET production and demand, waste management operations, recycling infrastructure, legislative developments, and the role of key stakeholders in driving sustainability.

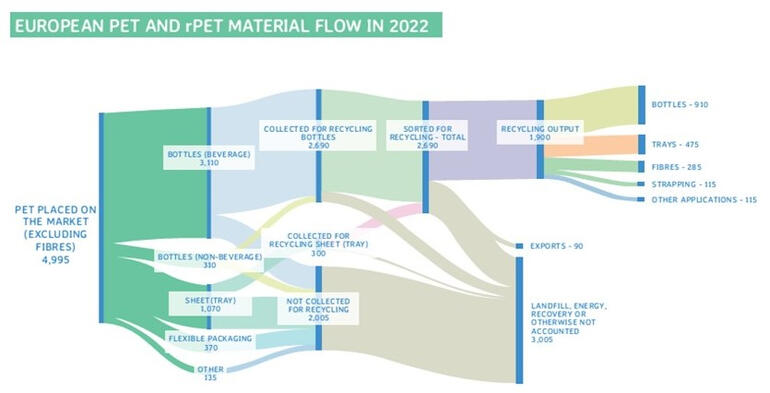

Key highlights of the State of Play 2024 study include: PET collection rate in 2022 increased to 60% (showing an increase from the 45% achieved in 2020), from the total of 5 million tons of PET resin utilised in the region; European extrusion capacity for rPET pellet production doubled to 1.4 million tons in 2022; existing European recycling capacity is deemed sufficient to meet short-term targets, with around 800,000 tons of rPET required to meet the SUPD mandatory recycled content targets for 2025.

Despite the positive progress, the study identifies regional disparities in collection and recycled content rates, emphasising the need for continued efforts in improving sorting infrastructure and harmonised waste collection to achieve long-term self-sufficiency in recycling PET. The collaborative endeavours of PET recycling participants have led to an improved recycling process and increased utilisation of rPET during 2022. Strategies such as Design for Recycle (DfR), Deposit-Return Systems (DRS), and the development of sorting technologies have contributed to the effectiveness of capturing PET packaging into the recycling stream.

The collection rate of PET in 2022 was 60%, showing an increase from the 45% achieved in 2020. Furthermore, the sorted for recycling rate for PET beverage bottles alone was estimated to be 75%, compared to 61% in 2020.This collection rate is expected to keep growing in years to come, due to the wider rollout of deposit-return systems across Europe. In 2022, 12 countries in EU 27+3 were reported to have this collection method operational, while 9 have taken the political decision to install DRS in the near future.

As for the collection, almost 2.7 million tons of PET waste were sorted for recycling. In addition, the total installed recycling capacity was around 3 million tons, out of which 1.4 million tons were destined for food contact applications. Packaging was the dominant end-use for rPET in 2022, with 48% used in bottles. This shows a very positive increase in bottle-to-bottle recycling in Europe. 25% of rPET was used in sheets (trays), and the remainder was used in non-packaging applications including polyester fibres (15%), strapping (6%) and others (6%).

To continue the trend towards true circularity, the disparities between EU Member States in terms of collection, recycling and uptake will need to be tackled, as today some countries are not likely to meet 2025 targets if no further investment is maintained. Therefore, specific actions per Member State need to be addressed to improve the waste collection and recycling infrastructure and take steps to meet the targets.

"We are excited to present the State of Play 2024 study, a comprehensive analysis of the European PET market. Through collaboration with industry leaders and organisations, we have compiled valuable insights that shed light on the challenges and opportunities within the PET supply chain. This study underscores the importance of continued efforts in improving recycling infrastructure and fostering sustainability across the region,” said Helen McGeough, Senior Analyst, Plastics Recycling at Icis.