In 2022 Italian manufacturers beyond all expectations

The year-end figures for 2022 are official and the picture painted by the Mecs Statistical Study Center, which published them, is a year worth framing: the plastics and rubber technology industry represented by Amaplast (Italian association of manufacturers of plastics and rubber processing machinery and moulds) closed the year with a turnover of 4.67 billion euros, the second-best performance ever. The variance with respect to 2021 is +5% and the December forecast (4.5 billion) proved to be somewhat cautious. And the balance among Amaplast members was even better (+9% turnover with respect to 2021).

The result is all the more satisfying if compared to the numerous difficulties confronting the industry over the course of the year - some of which are having continuing effects - between export limits to Russia, raw materials and component shortages, and skyrocketing energy costs. The main driver of this historical result was exports, which showed a particularly positive trend towards the end of the year, with a total value again above the threshold of 3 billion euros. After a most excellent 2021, the domestic market remained relatively stable, with a less pronounced increment of 0.8% and turnover of 2.54 billion euros.

In detail, exports by the Italian manufacturers - which continue to be the destination for 70% of production - show progressive growth towards the three principal geographical destination zones:

- Europe (EU and extra-EU): +8%;

- America: +12%, thanks mainly to South America (+33% overall, with peaks mainly for Brazil and also, albeit with lower absolute values, for Colombia, Chile, and Peru); in North America, sales to the United States have slowed somewhat (-3%) while Mexico has record-ed a strong new rebound (+35%);

- Asia: +9%; in the Far East (+9% on average), sales to India stand out at +24%, while China has retreated (-7%); in the Middle East (+11% overall) the driving forces are Saudi Arabia (+36%) and the Emirates (+58%).

Contradictory signals are arriving from the African continent, contrary to what was observed for 2021: exports to North Africa fell by 24% on average while those to sub-Saharan markets have increased by a similar proportion.

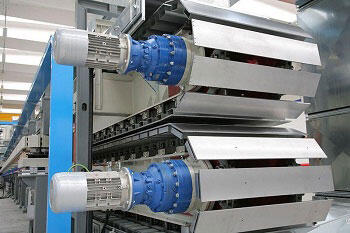

As regards export product categories, among machines for primary processing we observe robust growth in extruders (+23%) and mono- and multifilament systems (+58%), the latter a category that has shown significant progression over the past three years, going from 74 million euros in 2020 to the historical peak of 140 million in 2022, after the previous decade with values ranging between 30 and 50 million euros. On the other hand, injection moulding machines exhibit a relatively flat trend while blow-moulding systems and thermoforming machines have registered distinctly negative performance at -19% and -22%, respectively.

As regards the first quarter of 2023, the forecast based on an Amaplast member survey in early January highlighted the following expectations:

- +7% in orders (with respect to the same period in 2022); the outlook is positive, with substantially similar intensity, for both the Italian and foreign markets;

- +6% in turnover, still significantly positive but slightly less stellar than revenues from the previous quarters; sales abroad should once again be the principal source of satisfaction.

The outlook for the rest of 2023 remains uncertain, given the economic and political context that is still a bit up in the air. While the issue of energy costs and availability of raw materials and components has shown some partial improvement, troubles continue to be the order of the day - such as the recent bank crisis - and this makes any attempt to forecast the future quite challenging, to say the least. Focusing on the German competitors, on the basis of the most recent surveys, at the end of 2022 they recorded a thirteen-point drop in orders (the domestic market is particularly weak) coupled with a +10% in sales (sales abroad showing the principal positive signs). In this first glimpse of 2023, the gap between orders (-40%, with a collapse in domestic orders) and sales (+21% but here the best performance was observed at home) is only deepening. For the Italian segment of the industry, 2023 is above all the year of Plast, one of the world’s premier fairs for the plastics and rubber industry organized by Promaplast srl. After a five-year hiatus, the fair will open its doors again on 5-8 September 2023 at the Fiera Milano Rho (Milan) fairgrounds. Companies are getting ready to show the world the best of the Made-in-Italy in terms of design, materials, sustainability, and smart technology.