2016 exports: new historical record

Assocomaplast (Italian trade association, member of Confindustria, bringing together over 160 manufacturers of plastics and rubber processing machinery, equipment and moulds), through its Statistical Studies Center, has completed its year-end balance sheet for 2016, incorporating foreign trade data from Istat (Italian Institute of Statistics).

“In making a comparison with 2015 one immediately notes a new historical record for exports”, states a satisfied Alessandro Grassi, president of Assocomaplast. “They are approaching three billion euros, racking up an increase of 1.7%”.

There was even greater progress in imports, exceeding 12%, the outcome of a trend that continued to increase all along the year, reaching a total of 850 million euros. “Here too,” under-scores Grassi, “we are looking at levels we have never seen before, confirming signs that the domestic market is regaining altitude after many – too many – years of stagnation”.

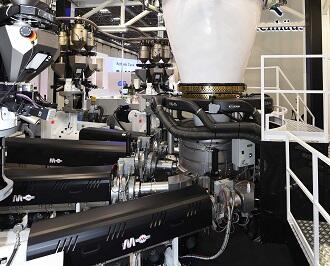

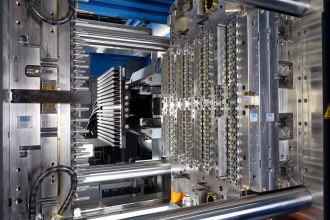

Robust growth was seen in purchases of injection moulding machines (+37%, much from Germany, Austria and Japan), extrusion machines (+39%, from Austria, Belgium and Germany) and blow moulding machines (+118%, from France and Germany).

This positive climate is also reflected in participation in the tradeshow Plast 2018 (Milan, 29 May-1 June 2018), which had already passed the threshold of 600 exhibitors by the end of January 2017.

As regards

production, in the absence of official data, Assocomaplast estimates that

revenues for the sector in 2016 had returned to pre-crisis levels, exceeding

4.2 billion euros.

As regards

production, in the absence of official data, Assocomaplast estimates that

revenues for the sector in 2016 had returned to pre-crisis levels, exceeding

4.2 billion euros.

Returning to exports, which absorb over 70% of production, sales of the following categories have been particularly significant: injection moulding machines (+18%), extruders (+5%) and thermoforming machines (+10%), just to cite some of the main types of systems for primary processing.

In terms of macro regions, an analysis of the geography of exports reveals the following:

- a decrease in share to European markets, dragged down principally by less-than-stellar sales to countries outside of the EU

- an increase of share to Asia, with Iran and Saudi Arabia ensuring sales to the Middle East, and China, India and South Korea driving those to the Far East

- overall progress in exports to North America thanks to +70% to Mexico, since as we shall see below, the US market, after years of growth, did not reward Italian manufacturers last year.

In greater detail, in the top ten destination markets, we record double-digit growth in sales of Italian technology to Mexico (leaping from eighth to third place, +71%), Poland (fourth, +13%), China (fifth, +12%) and Spain (sixth, +18%).

In reference to other destinations of particular interest, we report the following dynamics:

- the German market, historically Italy’s number one trading arena, maintains its value (+2% over 2015)

- -11% for the United States, where a slowdown in exports began around the middle of last year

- a 45% increase for India, now in eleventh position, which is particularly significant if we consider the complexity of this market

- a persistent negative sign for Russia, shrinking by eighteen percentage points

- and a collapse (-38%) was also recorded for Brazil, where the plastics industry has not been left unscathed by the general decline of the domestic market.

The most

recent survey conducted by Assocomaplast among its members reveals a good trend

in orders, with 43% of respondents foreseeing improvements in the current half

year over July-December 2016, and a similar proportion expecting also to see an

upturn in revenues.

The most

recent survey conducted by Assocomaplast among its members reveals a good trend

in orders, with 43% of respondents foreseeing improvements in the current half

year over July-December 2016, and a similar proportion expecting also to see an

upturn in revenues.

Expectations in the industry for 2017 are thus rather positive, further buoyed by the measures to support investment in capital equipment - super-amortization, hyper-amortization, the new Sabatini law, tax deductions for R&D - implemented also as part of the National Plan Industry 4.0.

“It bears mentioning”, continues Grassi, “that Italian manufacturers of plastics and rubber pro-cessing machinery, equipment and moulds are traditionally at the technological cutting edge and thus already prepared to provide their customers with advanced and innovative production systems within an “Industry 4.0” vision. In any case, this objective will represent a further stimulus for companies to increase investments in designing machinery that is increasingly high performance and competitive”.