Slowdown in foreign trade

According to analyses by the Amaplast Statistical Studies Centre of Istat foreign trade data, imports increased by 11.4% and exports decreased by 0.6% in the period January-September 2018 with respect to the first three quarters of 2017. The strong growth in imports, while remaining in the double digits, slowed significantly compared to +26% in March and +23% in June.

Exports remained weak: toward the end of the period they dipped into negative figures and back into positive by a few decimal points on more than one occasion.

The balance of trade, well in the black at 1.62 billion euros, contracted by five percentage points.

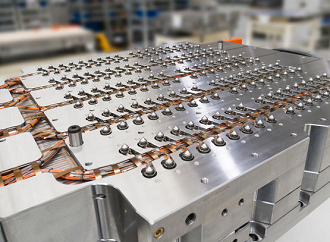

Regarding performance by machinery type, the trend is still quite positive for injection machines, extrusion lines, and blow moulding machines while dropping off for auxiliary equipment and moulds.

An analysis of exports by region shows major shifts in Asia with the Far East showing growth (+9.7%, led by India and South Korea) while things are not so bright in the Middle East (-37.1% due to falling sales in the main markets of Saudi Arabia, Iran, UAE, and Israel). As regards the New World, the Nafta countries record positive results (+6.5%, thanks mainly to good sales performance in Mexico) while Central and South America - where Brazil holds its ground while Argentina slumps - record overall negative numbers (-12.9%).

Northern Africa has taken strong steps ahead (+13.0%), contrasting with weaker sales in the sub-Saharan markets (+0.8%).

Lacklustre exports in Europe, where overall results are identical to those for the EU member states (-1.2%). The CIS countries performed poorly (-12%, mainly due to stalled sales to Russia, a market which had previously seemed to be recovering) with respect to other European countries (+14%).

“The flat

trend in sales abroad comes as no great surprise given an overall economic

context that is losing vigour, both in Italy and in Europe generally,” stated

Amaplast president Alessandro Grassi. “Even our German competitors are coming

to terms with an abrupt drop in exports, still in the double digits this past

March and June, falling to +4.5% in September.”

“The flat

trend in sales abroad comes as no great surprise given an overall economic

context that is losing vigour, both in Italy and in Europe generally,” stated

Amaplast president Alessandro Grassi. “Even our German competitors are coming

to terms with an abrupt drop in exports, still in the double digits this past

March and June, falling to +4.5% in September.”

The most recent mid-year Amaplast member survey reveals slightly less than half expecting stable turnover at the end of the current half-year, while one third expect continuing growth. As regards order books, the optimist camp makes up only one fifth of the total.

In light of these data, we expect year-end production and foreign trade results for the Italian plastics and rubber processing machinery industry roughly in line with 2017. This must be considered a positive result given that 2017 was the best in the past five years.

The outlook is cautious for 2019 for two reasons:

- uncertainties about the overall economic climate both in Italy and in Europe (with the prospect of elections in the spring), compounded by uncertainties on the global level due to tensions among the major players and the barriers - tariff and others - they have erected; regardless of political questions, the Italian industry of plastics and rubber processing machinery has recorded an upward trend from 2010 to 2017, with the sole exception of 2013; we are now rather used to the volatility in the global economy and the current slowdown in demand has not caught anyone by surprise;

- increasing

pressure toward a more virtuous production and consumption system in keeping

with the principles of the circular economy; Italian manufacturers may

certainly consider themselves ready to undertake the challenge; they are able

to produce systems that can handle not only virgin polymers but also recycled

materials in increasingly high percent-ages, consuming less energy to produce

items that perform; while it might be taken as a threat at first sight, the turn

toward the circular economy is actually an excellent opportunity for growth for

manufacturers of plastics and rubber processing machinery, equipment and

moulds.

- increasing

pressure toward a more virtuous production and consumption system in keeping

with the principles of the circular economy; Italian manufacturers may

certainly consider themselves ready to undertake the challenge; they are able

to produce systems that can handle not only virgin polymers but also recycled

materials in increasingly high percent-ages, consuming less energy to produce

items that perform; while it might be taken as a threat at first sight, the turn

toward the circular economy is actually an excellent opportunity for growth for

manufacturers of plastics and rubber processing machinery, equipment and

moulds.