New record for Italian machinery manufacturers

Amaplast

(Italian trade association, member of Confindustria, bringing together about

170 manufacturers of plastics and rubber processing machinery, equipment and

moulds), through its Statistical Studies Centre, has completed its year-end

balance sheet for 2017, incorporating foreign trade data from Istat (Italian

Institute of Statistics).

Amaplast

(Italian trade association, member of Confindustria, bringing together about

170 manufacturers of plastics and rubber processing machinery, equipment and

moulds), through its Statistical Studies Centre, has completed its year-end

balance sheet for 2017, incorporating foreign trade data from Istat (Italian

Institute of Statistics).

Double digit increase over 2016 in all macroeconomic indicators means new all-time records for the sector. Lacking objective statistical surveys, Amaplast analyses show production sustained by excellent performance in exports, the destination for 70% of the Italian-made products in the sector, as well as by the domestic market, which is showing clear signs of recovery, probably explained by the measures implemented by the National Industry 4.0 Plan to support investment in capital equipment. The expansion of the domestic market is also signalled by quite positive performance in imports.

“The order portfolio horizon for Italian manufacturers,” underscores the satisfied Amaplast president, Alessandro Grassi, “has been considerably extended: many companies are able to plan production at least to the end of the year, and there are quite a few that are actually having difficulty keeping up with customer requests”.

Geography of exports

Regarding macro-areas, the geography of exportation has witnessed overall growth in European destinations, mainly within the EU, where the top two export markets, Germany and France, have grown by more than 20 percentage points since 2016.

However, impressive numbers are also seen much further down in the rankings, specifically in tenth place, where Romania records a whopping +69% with a surge in purchases during the last quarter that once again dislodged Russia from the top ten (by just one spot) after it had clawed its way back last September. Nevertheless, the Russian recovery still continues apace (+67%) with the value of Italian machinery exports nearly reaching 100 million euros.

The trend in sales to Asia has not been particularly brilliant due to a slowdown in exports to the Middle East (especially Saudi Arabia and Iran), and only modest growth (less than +5%) in sales to the Far East, where the two major markets have slipped somewhat: China (-2.5%) and India (-6%).

As regards

the two major North American markets:

As regards

the two major North American markets:

- sales to the United States record final growth of 20%, following peaks as high as +30% during the year;

- supplies to Mexico, on the other hand, have fallen by approximately 17%, which at least took some of the edge off the more than 20 point losses in previous months. No one expected the 2016 boom to last forever.

The Trump administration’s threat to impose import duties on various product categories is not expected to affect plastics and rubber processing machinery, equipment and moulds. US production in this sector cannot meet demand from local manufacturers and the duties would only be counterproductive.

In South America, the recovery in the flow of supplies to Brazil continues unabated, approaching +40% with respect to 2016 for overall value once again over 50 million euros.

Goods categories

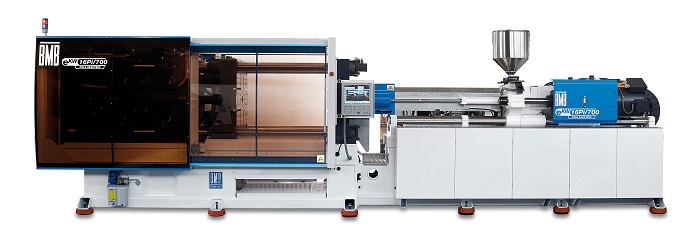

As regards goods categories, worth noting is the particularly positive trend in sales abroad of all the main types of machinery for primary processing and for moulds, which traditionally represent just under one third of Italian exports for the sector.

The entire range of plastics and rubber processing lines, machinery, and auxiliary equipment will be exhibited by hundreds of Italian and foreign companies - naturally along with raw materials, semi-finished products, finished products, and other articles - at Plast 2018, taking place in Milan from May 29 to June 1.

And it is precisely the figures regarding foreign participation - at the moment registering a growth exceeding 20% over the previous Plast - that confirm the renewed interest in the Italian plastics and rubber processing industry, and also operators’ interest in the Italian three yearly show, which thus reaffirms its international stature.

“Participants at Plast 2018”, continues Grassi, “are particularly confident that they will be able to do significant amounts of business and expand their order books directly at the fair”, adding that “several thousand operators have already pre-registered for their visit and our office is working to organize delegations of buyers from some thirty countries”.