Starting anew from Shenzhen

The Italian pavilion at the thirty-fourth edition of Chinaplas (Shenzhen, April 13-16, 2021) organized by Amaplast (trade association in Confindustria uniting over 160 manufacturers of plastics and rubber processing machinery, equipment, and moulds) will include some forty companies in a space of 1,100 square metres.

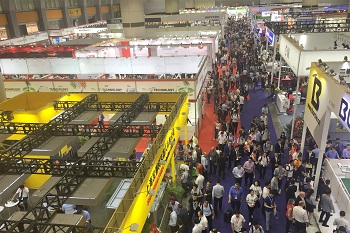

The Chinese tradeshow - which will be inaugurated in the Shenzhen fairgrounds instead of those in Canton, where it has always taken place in alternation with Shanghai - is the first specialized international fair to take place on an in-person basis after a year of lockdown due to the Covid-19 pandemic.

And it is certainly no surprise that Chinaplas is leading the way to the resumption of tradeshows for the plastics and rubber industry. After being the one to bear the initial impact of the epidemic, the Chinese economy was the first to set out on the road to recovery and for some time now has recorded the highest growth rates.

As regards the consolidated results for 2020 for the Chinese plastics industry, a recent study by a technical magazine reports that, in spite of the pandemic, 75% of companies ended the year with an increase in revenues with respect to 2019. As for 2021, over 90% of those surveyed have a positive outlook and many have already implemented investment plans, mainly in advanced technology and automation.

The strong participation of Italian manufacturers of plastics and rubber processing machinery at Chinaplas 2021 - although their stands will be manned by local representatives, given the continuing restrictions on international travel - reaffirms the great strategic importance of the Chinese market, which was ranked fifth among destination markets for Italian exports in the sector in 2020. Indeed, at approximately 145 million euros, the value of Italian-made technology did not shift far from the peak of 150 million for the decade reached in 2019. And extruders and extrusion lines continue to represent a significant share. Built on a turnkey basis and offering maximum flexibility, these are high-tech systems enhanced with Industry 4.0 solutions unlike anything that Chinese converters are likely to find on the local market.

As always, the Italian collective at Chinaplas 2021 includes many Amaplast (which will be present at stand E51 in Hall 10) members: Amut, Bandera, Bausano, Borghi, Cemas Elettra, CMS, Colines, Comerio Ercole, Electronic Systems, Frigel Firenze, GAP, Helios Italquartz, Matex, Moretto, Omipa, Omso, Piovan, Plas Mec, Rodolfo Comerio, Sacmi Imola, Sima, Sipa, Sorema, ST Soffiaggio Tecnica, Tria, Union, Zambello Riduttori.

As always, the Italian collective at Chinaplas 2021 includes many Amaplast (which will be present at stand E51 in Hall 10) members: Amut, Bandera, Bausano, Borghi, Cemas Elettra, CMS, Colines, Comerio Ercole, Electronic Systems, Frigel Firenze, GAP, Helios Italquartz, Matex, Moretto, Omipa, Omso, Piovan, Plas Mec, Rodolfo Comerio, Sacmi Imola, Sima, Sipa, Sorema, ST Soffiaggio Tecnica, Tria, Union, Zambello Riduttori.

In 2020 revenues for Italian plastics and rubber equipment manufacturers recorded a drop of 11.4% to a total value of 3.9 billion euros.

According to data from the Mecs-Amaplast Statistical Studies Centre, the result was caused by a contraction in the domestic market (-12.5%) to 1.96 billion euros and by a drop in sales on foreign markets (-11.2%) to 2.72 billion euros. A final factor was a 14.3% reduction in imports to 780 million euros.

In any case, affirming a countertrend with respect to 2020, half of the member companies that took part in a recent Amaplast survey reported growth in orders in the first half of 2021 with respect to the second half of 2020, albeit to varying degrees.

Growing Chinese demand for polymers to supply increasing local product manufacturing has contributed to rising raw material prices and scarcity on the global market. This naturally affects Italian converters, who for weeks now have had to cope with significant provisioning challenges. Meanwhile, the scarcity of steel, other materials, and components coupled with rising sea freight rates are causes of concern for machinery manufacturers.